Debt Consolidation Loans for Bad Credit UK – Top 10 Loan Providers

In today’s hectic environment, you need to make things as simple as possible. One method is to manage your outstanding monthly payments via debt consolidation. So, let us learn more about the finest debt consolidation services to select. Let’s have a look at the top 10 debt consolidation loan providers for bad credit in UK.

You may pay everything off in one monthly payment, making it simpler to clear your exceptional sums and maintain track of your various bills. Some folks may achieve this by using the most outstanding debt consolidation loans, which we will cover.

The advantages of this method are enormous. You may, for example, be able to benefit from a cheaper interest rate on your debt consolidation loans.

Debt Consolidation Loans for Bad Credit UK – Top 10 Loan Providers

1. 118 118 Money

Money is what keeps Britain functioning! Its mission is to offer you cost-effective, individualized financial solutions—118118 Money deposit loans within 24 hours.

So, you may typically receive it as quickly as a payday loan, but at a considerably lower interest rate and far better repayment conditions. If you are accepted, you will get a welcome call from us to confirm a few things.

2. Money Mutual

The first is an extensive network of lenders that specialize in short-term loans. Over 60 lenders can assist you with loans, whether your objective is debt consolidation or to gain some additional money for a cost. You begin by visiting their website and completing the pre-qualifier questionnaire.

Then, lenders that can lend to you will approach you regardless of your credit score. This website enables you to contact lenders to acquire the financial aid you need. The most significant thing is that you may have your cash in as soon as one business day following approval. This firm is reputable, and you may deal with them with confidence.

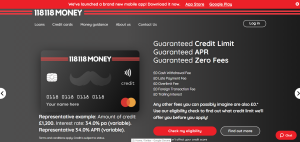

3. Bamboo

If you need to borrow between £1000 and £8000, a personal loan might be a great alternative. Private loans do not need a guarantor and might be an excellent option if you do not qualify for a bank loan. Bamboo provides you with the choice.

They provide a personalized fast quotation, enabling you to see which loans you could be eligible for without affecting your credit score. Their company was founded to assist consumers who traditional banks could not help. They are not the broker; they are the lender, and they place their consumers at the centre of their operations.

4. FundsJoy

People often struggle to control their monthly spending; consequently, They remain in debt and get trapped in a never-ending cycle of unsustainable debt. Bad credit does not stop you from acquiring a personal or payday loan, according to FundsJoy. You may apply even if your credit score is poor.

From the outset, it is clear that loans secured via FundsJoy are adaptable. You may get a loan for a certain amount of money. If you are accepted for a loan, you can look through your choices and make modifications to ensure that the repayment plan works for you.

5. Everyday Loans

Everyday Lending Limited was founded in 2006 and has branches around the country; we are the brand behind the simple method for anyone to borrow money in the UK. They are a UK-based independent personal loan provider. Everyday Loans see you as more than simply a credit score.

They consider your credit card future as well as your credit past. You do not have to be a homeowner; they also provide loans to renters. We also offer loans to those who live with their parents.

6. BadCreditLoans

Those who have previously struggled may rebuild and receive a second chance with these modest loans, which can be a terrific way to enhance your credit score. These loans may be used for various purposes; however, they should only be utilized for required costs such as medical bills or, in this instance, debt consolidation.

Furthermore, bad credit loans, like MoneyMutual, are a marketplace of lenders. The loans provided are not provided directly by BadCreditLoans. Instead, it links you to a vast network of lenders who give you proposals to examine.

7. Monexo

They are entirely devoted to offering excellent goods and customer service. Throughout the process, Monexo has followed industry best practices to ensure the protection and confidentiality of your personal information. They allow you to withdraw your available balance with ITSL at any moment by sending an email to contact@monexo.co.

The money you have previously disbursed to a borrower and those pledged in the marketplace will only be available for withdrawal when you receive borrower repayments.

8. Navy Federal

Personal loans from Navy Federal are excellent for members with acceptable credit who wish to finance a home repair project. Navy Federal Credit Union provides diverse personal loan sizes and payback arrangements, making it a versatile alternative for borrowers. Personal loans are only offered to current Navy Federal members, who include service personnel and their families.

9. OneMain

On a loan application, OneMain highlights a borrower’s capacity to repay. Although the rates are hefty, this lender accepts poor credit ratings. Personal loans from OneMain are more costly when compared to other online loans; nevertheless, they contain several consumer-friendly characteristics that make them an alternative for borrowers who may struggle to qualify elsewhere.

10. Upstart

Through Upstart’s loans lack flashy features, they are a quick-funding choice for individuals with poor credit ratings and high earning potential. Upstart underwrites personal loans utilizing alternative data and artificial intelligence to provide borrowers with terrible or fair credit with a higher chance of qualifying and receiving a cheap interest rate.

Conclusion

If you’re ready to take responsibility for your money, debt consolidation might be a valuable tool for streamlining payments and lowering interest costs. It may also reduce your monthly loan payments. The most OK personal loans for debt consolidation include low annual percentage rates (APRs) and flexible repayment periods while avoiding expenses such as prepayment penalties, allowing you to eliminate debt early without liability.