Tax Rebate for Working From Home in UK – A Complete Guide

Are you looking to take the tax-saving plunge and work from home? If so, you’re in luck – as the government has announced a working-from-home tax rebate in the UK. This tax rebate allows people to claim tax relief of up to £900 for each year of claiming it, up to a total of £27,000.

In addition, those who work less than 30 hours per week can also claim tax relief of £500. So whether you’re a freelancer, self-employed person, or full-time employee who would like to work from home occasionally, this blog is for you!

Along with explaining all you need to know about the working-from-home tax rebate in the UK, this blog will also give you tips on how to claim it and how the money is paid. So read on and start saving today!

What is the Working from Home Tax Rebate in UK?

The Working From Home Tax Rebate in the UK is a government incentive that encourages people to work from home. If you meet the eligibility criteria and are working from home at least 30 hours per week, you are eligible for a tax rebate.

All you need to do is submit an official HMRC declaration form, and you’re good to go! The rebate is based on your earnings, and there is no need to deposit any paperwork or provide proof of your income – all you need is the form. If you’re not sure whether working from home qualifies as part of your job, speak to someone like an accountant or tax advisor for help!

Who Can Claim Tax Relief?

There’s good news for those who work from home – we can claim tax relief on our earnings! This includes freelancers, consultants, and those working from a home office. All you need is proof of your work and that you’re claiming tax relief on your earnings.

It’s important to keep track of all your paperwork – this is where having an accountant or specialist could help. In the end, it’s worth it to take the time to claim tax relief for working from home – it could mean a substantial boost to your monthly income.

Who Cannot Claim Tax Relief?

Sadly, some people are not eligible for the Working From Home Tax Rebate in UK. This includes self-employed people who work from home as their main business and those working part-time. You also cannot claim tax relief if you receive remuneration in kind (such as paid holidays or commission). If you’re unsure whether your work qualifies as part of your job, speak to an accountant or tax advisor!

What You Can Claim for?

The tax relief available for working from home is based on your earnings. This means that you can claim a tax refund for any income you earn- salary, commission, overtime pay, or tips.

You don’t need to provide proof of your income; you only need the HMRC declaration form. The amount of tax relief that you’re eligible to receive will depend on your earnings and circumstance.

If you’re unsure how much tax relief you could claim, speak to an accountant or tax advisor!

How Much You Can Claim?

The amount of tax relief you can claim depends on your tax rate and the number of hours worked per week. If you’re claiming the basic council tax exemption, which is currently £8,000 for singles or £16,000 for couples filing jointly, you can claim up to 20% of your qualifying income as a tax rebate.

If you’re claiming the higher-rate relief (e.g. 35%), then you may be able to claim 50% of your qualifying income as a tax rebate. Finally, if working from home meets all three conditions listed above – operating your small business as an independent contractor and meeting the physical presence test – you can claim 100% of your qualifying income as a tax rebate. So, if you’re earning £10,000 per year working from home, you could claim £2,500 as a tax rebate.

What Do I Need to File?

You need to file a tax return using the online HMRC self-assessment tax system. You can use this system even if you don’t have internet access, so long as you have your taxpayer number and PIN. Once you’ve filed your return, the relief you’re eligible for will be automatically transferred into your bank business account within 14 days.

How to Claim Tax Rebate for Working From Home?

Working from home could be a great way to save money on your taxes. Here are the requirements for getting a working from home tax rebate in the United Kingdom:

- You must be registered with HM Revenue and Customs (HMRC).

- You must e-file your taxes using their online tax system.

- You must have an annual income below £50,000.

- Your employer must give you the approval to work from home.

- You must have an Internet connection and a computer that is suitable for working from home.

- You must keep accurate records of your hours worked and the expense deductions you make for work-related expenses.

- You must maintain a physical presence in the United Kingdom for at least 33 weeks out of the year.

- Your business must be an independent contractor, not part of your employer’s organization.

- You must meet the other usual requirements for claiming tax reliefs, such as having tax-deductible expenses and meeting income qualifications. See the online HMRC self-assessment guide for more information on claiming tax relief.

There are a number of ways to apply for the Working from Home Tax Rebate in the UK. You can submit your application online, via post, or in person.

You can apply online by visiting the HMRC website and completing the online working from home tax rebate application form. Below are the steps to apply for and claim a tax rebate online.

- Open the HMRC self-assessment system online.

- Log in using your taxpayer number and PIN.

- Click on Tax Reliefs & tax credits in the left-hand navigation bar, and then click on Working from Home.

- In the Working from Home tax relief section, you will find a list of all available tax reliefs based on your income and circumstances (e.g., basic exemption, higher rate relief). It is important to note that some of these reliefs may be limited depending on how much money you make – speak to your tax advisor if you are unsure.

- Click on the relief that applies to you and read all of the conditions carefully.

- If all three conditions are met – operating your business as an independent contractor and meeting the physical presence test – then claim 100% of your qualifying income as a council tax rebate in the Tax reliefs & Tax credits section of the online HMRC self-assessment system.

- Click on the claim button, and attach all required documents (e.g., tax return, self-assessment form S2AWA) to support your claim.

- The relief will be transferred into your bank account within 14 days of filing online – so don’t wait!

You can also apply via post by sending the completed application form and getting a passport copy or identity document to the HMRC address listed on the form. Below are the steps to apply and claim a working home tax rebate through the post,

- Download the HMRC Tax Rebate Application Form (ATR-0353)

- Complete and attach to the form all required documents such as tax return, self-assessment form S2AWA, etc.

- Send to the following address via post:

HMRC, P O Box 9771, London NW1 0ND

Please note you may also be able to claim reliefs such as the basic tax allowance or higher rate relief online through the self-assessment system. Speak to your tax advisor if you are unsure what reliefs may apply.

If you want to apply for the tax rebate in person, you will need to visit your local HMRC office and provide proof of your identification, such as a driver’s license or passport.

Once you have completed the application form and submitted all of the required documentation, it will be processed, and a tax rebate cheque will be issued in approximately six weeks. Follow the steps below to apply and claim a tax rebate working from home in person,

- Visit your local HMRC office and provide proof of identification

- Complete the tax rebate application form ATR-0353 and attach all required documents (e.g., tax return, self-assessment form S2AWA, etc.)

- Submit to the nearest HMRC office

- You will be notified of the outcome of your application, and if you are successful, a tax rebate cheque will be issued in approximately six weeks. If you have any questions or need help applying for the tax rebate while working from home, please do not hesitate to contact your tax advisor.

Working from home can be a great way to reduce your tax burden, but it’s important to factor in the tax reliefs that are available to you. By following the step-by-step process outlined above, you will be able to claim 100% of your qualifying income as a tax rebate. So don’t wait – get started today and see how easy it is to file your return online with HMRC!

Working From Home Tax Rebate – How is It Paid?

Once you have filed your return online and claimed the tax rebate, the relief will be transferred into your bank account within 14 days. The payment process is fairly straightforward – simply request a transfer from your lender or bank and include the taxpayer number (which you can find on Page 3 of your tax return) and PIN. Once the payment has been processed, you will receive a notification in the mail.

What are the tax reliefs available to self-employed people?

There are a number of tax reliefs available to self-employed people, including:

Self-employment allowance: This allowance is designed to help you cover the extra costs that go along with being self-employed. The amount of this allowance depends on your income and whether or not you have other income from working for someone else. You can claim this allowance if your total income does not exceed £5,000 per year.

Startup costs relief: If you’re starting a business, you may be able to claim relief on the costs you pay for things like legal fees, equipment, and advertising. You can claim this relief if your total business costs (including start-up expenses) do not exceed £12,000.

Income tax deduction for self-employment expenses: This allowance allows you to deduct a certain amount of your self-employment income from your taxable income. The amount of this deduction depends on the type of business benefits you’re in and whether or not you have other income from working for someone else.

To qualify for this allowance, all of the following conditions must be met:

- You must be self-employed.

- The business must be your sole or main activity.

- You must use the profits you make from the business to pay for expenses that are associated with being self-employed, such as tax advice, insurance premiums, and costs related to starting and running your own business (for example, advertising).

- You can claim the allowance only if you have receipts to prove that you spent the money required to qualify.

In addition, self-employed people may be able to claim tax relief on expenses related to their business, such as:

Expense relating to your trade or business: This includes costs associated with things like rent, employee salaries, and supplies needed for your business. You can claim this relief if all of the following conditions are met:

- The expense is necessary for running your trade or business (for example, employee salaries and equipment purchases).

- The cost is not tax deductible elsewhere (for example, public transport).

- The expense is not a capital expenditure.

Business use of your home: If you use part of your home to carry out self-employment activities, you may be able to claim tax relief on the rent you pay for this space. You can claim this relief if all of the following conditions are met:

- You live in the property and use it mainly to run your business.

- The total amount of rent paid in a year does not exceed £40,000.

- You have been claiming mortgage interest deduction or rental expenses allowance on the main residence used as your principal place of residence.

Other expenses related to self-employment: You may claim costs such as business advertising and legal fees if necessary for running your business.

Conclusion

Are you looking to work from home but are unsure of the tax reliefs available in the UK? Don’t worry; we’ve got you covered! In this blog, we’ll be discussing the Working from Home Tax Rebate in detail, mentioning who can claim relief, what you can claim, and how the relief is paid.

So, whether you’re in the UK or planning to move there soon, check out this guide for all the details you need to claim tax relief for working from home!

Frequently Asked Questions – Tax Rebate Working From Home

How much do you get back from HMRC for working from home?

There is no one-size-fits-all answer to this question, as the tax rebates you get will vary depending on factors like your annual income, filing status, and whether you have children. However, most people who work from home in the UK can expect to get back up to £1600 in tax rebates.

Keep all the important paperwork and receipts related to your claim neatly organized so that it’s easy for HMRC to process your claim as quickly and efficiently as possible. Additionally, make sure to keep track of the deadlines involved so that you don’t miss out on any important tax breaks.

Can I get working tax credits if I work 40 hours?

Yes, you can claim the working tax credit if you have worked at least 30 hours a week and earned less than £8,000 in a year. To claim the tax credit, you must register with HMRC by filling out an online form or visiting your local office. Once registered, you will be sent a P60/P41D for the months you worked. You will need to attach this form to your returned income tax return as proof of your earnings.

How much can you earn and still get tax credits UK?

To sum it up, here’s how much tax relief you can get for working from home in the UK:

- The amount of tax relief you can get for working from home varies depending on your income and filing status.

- If you’re married, or in a civil partnership, you can earn up to £3,800 a year without paying any extra taxes.

- Single people who are earning under £5,500 may be eligible for full tax credits.

- If you work between 5 and 16 hours per week, the government gives 75% of your earnings as tax relief.

How many hours do you need to work to get in work tax credit?

You must work at least 30 hours a week to claim the working tax credit.

Can you claim tax credits if you don’t have a job?

Yes, you can still claim tax credits if you don’t have a job. However, the government gives less relief for working from home than it does for having a full-time job. What are the tax credit deadlines?

If you want to claim tax relief for working from home, you must file your return by the April deadline (for UK tax year tax returns).

What if I can’t fill out my online form or visit my local office?

If you can’t go through the online process or need help claiming your tax credits, a few options are available. You can contact HMRC’s Tax Help Line or write to them requesting assistance. You can also find Local Tax offices in the Yellow Pages.

Can I get Working Tax Credit if I work 35 hours a week?

Yes, you can claim Working Tax Credit (WTC) if you work a minimum of 35 hours a week and meet the eligibility criteria. To learn more about WTC and if you qualify, visit the government website at gov.uk/working-tax-credit/.

What if I don’t have a tax code?

If you’re not registered for tax and want to claim tax credits, you’ll need to get a tax code. You can do this by completing an application form or by contacting HMRC’s Tax Help Line.

Can I claim tax relief if I’m self-employed?

Yes, you can claim tax relief for working from home if you’re self-employed. However, the government gives less relief for working from home than it does for having a full-time job.

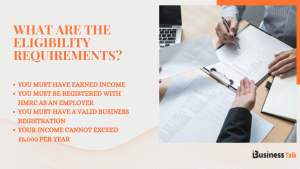

What are the eligibility requirements?

To qualify for tax credits as a self-employed person, you must meet all of the following eligibility criteria:

You must have earned income: This includes any income that’s been earned through your own work or business activities.

You must be registered with HMRC as an employer: If you’re self-employed and haven’t registered with HMRC, your tax relief may be reduced.

You must have a valid business registration: Your tax relief may be reduced if you’re self-employed and don’t have a business registration.

Your income cannot exceed £5,000 per year: Your income is the total of all of the following: Salary or wages earned from working for a company or other formal organization Energetic expenses, such as rent payments for work premises, Insurance premiums, Income from property (other than mortgage interest) You can claim back tax relief on the first £2,000 of your income.

Can I claim tax relief if I’m self-employed and work from home part-time?

Yes, you can claim tax relief for working from home part-time if you meet all the eligibility requirements listed above. However, the government gives less relief for working from home part-time than it does for having a full-time job.

How do I claim 312 for working from home?

To claim tax relief for working from home, you’ll need to complete a self-assessment tax return (known as an “IR35 return”). You can find more information about claiming tax relief on the HMRC website.

What are the tax relief benefits of working from home?

Working from home can have a number of tax relief benefits. These include:

Reduced commuting costs: You may be able to claim tax relief for the expenses associated with commuting, such as fares and parking fees.

Reduced work-related distractions: Working from home can help you avoid distractions at work, which can reduce your chances of making mistakes and causing damage to your private limited company’s property.

Greater flexibility: If you’re self-employed, working from home may allow you to set your own hours and schedule: This can be a great way to balance your work and personal life.

Reduced stress: Working from home can help reduce the amount of stress you experience during your workday.