Lost UTR Number – How to find it?

In order to establish a business in England, the first thing you need to do is obtain a Unique Tax Reference Number (UTR). This registration number is referred to as UTR or UK Business Number.

In many ways, this number functions similarly to your Social Security Number – your unique identifier will allow you to meet all of the legal requirements government officials should have for ensuring your tax affairs are properly managed and secure.

If you’re a business owner or manager, you know that your UTR number is one of the key pieces of information that can help you conduct business in the UK. But what if you lose your UTR number?

Don’t panic – you can do a few things to get it back. In this blog post, we will outline the steps you need to take to find your lost UTR number and get back up and running as quickly as possible.

What Happens if I Lost My UTR Number?

UTR number is essential for every business in the UK; here we have listed a few important things that can happen if you lose your UTR number,

1. You Cannot Move to New Address, and you cannot do any banking

Losing your UTR number will prevent you from accessing your bank business accounts, mortgages, and other services. You can only get a new UTR if you can prove that you have moved and your new address is registered with the government.

You cannot move to a new address or do any banking. In order to open a bank account or get a mortgage, you will need to provide evidence of having moved and have your new UTR registered with the government.

If you have lost your UTR number and do not have another form of identification, such as a driving licence or passport, it may be difficult to prove that you have moved.

2. Your Documents are at old address so you will have to spend time looking for new ones and redoing any papers/references

If you have lost your UTR number, this can mean a lot of work for you. You must find your old address and contact any universities or colleges you applied to with your UTR number. You must also redo any papers/references you submitted with your UTR number. If you are not able to locate your documents or if you need help redoing your references, there are organizations that can help.

3. Make sure your friends, family, or helpers have access to emergency grants that may help pay rent or bills

If you lose your UTR number in UK, you may be unable to access emergency grants that may help pay rent or bills. You can find out how to get a UTR number and keep it updated online or through the UK government’s website. Call your local social care agency for advice if you have an emergency and cannot afford to pay your rent or bills.

4. You will lose all subsidies such as Pension and Tax Credits

If your UTR number is lost or stolen, you will no longer be eligible for most government benefits and subsidies. These include Pension and working Tax Credits, which means that you will have to pay back any money you’ve received. Your UTR number is important because it’s used to identify you when applying for benefits.

5. If you are over the age of 18, you will no longer be able

If you are over the age of 18, you will no longer be able to obtain a UTR number in England. If you have an expired UTR number, you must apply for a new one and provide identification proving your age. If you do not have an ID, you can submit a letter of identification from your employer or civil servant confirming your age.

6. You could be fined

The Department for Transport (DfT) may impose a fine if you lose your UK driving licence. The maximum fine is currently £5,000. If you are convicted of any offence while driving without a valid UTR number, the court may also impose a fine and disqualification from driving.

7. Your name won’t appear on the electoral register

If you lose your UTR number, your name won’t appear on the electoral register. This means that if you want to vote in UK elections, you’ll need to contact the Electoral Commission and provide them with proof of identity (like a passport or driving licence). If you’re a student, you can also get an election card.

8. You won’t be able to vote in the UK general election

You are not eligible to vote in the UK general election as you are not a British citizen.

9. You might not be able to get a passport

If you lose your UTR number, you might not be able to get a passport. In order to apply for a passport, you will need to provide proof of your identity and citizenship. If you do not have your UTR number, you must contact the passport office to retrieve it.

10. You will need to get a replacement card

If you lose your UTR number, you will need to get a replacement card from the Driver and Vehicle Licensing Agency. You can do this by visiting one of their offices or by calling them; if you live outside of the UK, you will need to contact your local Driver and Vehicle Licensing Agency to get a replacement card.

11. You may have to pay more in taxes

If you lose your UTR number in the UK, you may have to pay more taxes. Here are five things that can happen,

1. You’ll have to pay income tax on any money you earn while your UTR is inactive.

2. You may have to file a return using an Individual Taxpayer Reference Number (ITRN).

3. You may be subject to additional tax penalties if you don’t file a return or if you underreport your income.

4. Your credit rating may be affected if you don’t maintain good tax records.

5. If you’re convicted of a paying tax offense, your UTR could be suspended or cancelled, which could affect your ability to work in the UK or carry out other activities involving UK residency.

12. You may lose your job

If you lose your UTR number, you may not be able to work in the UK anymore. This is because your UTR number is a part of your immigration status. If you lose your number, you will need to apply for a new immigration status. You may also need to find a new job.

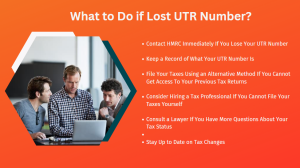

What to Do if Lost UTR Number?

If you have a UK taxpayer reference number (UTR), then you are in luck! This unique identification number is required by the government in order to track your tax affairs. Without a UTR number, filing your taxes and reclaiming any money you may owe is very difficult. Here are some important things to do if you lose your UTR number,

Contact HMRC Immediately If You Lose Your UTR Number

The first thing you should do if you lose your UTR number is contact HMRC. Without a UTR number, filing your taxes and reclaiming any money you may owe is very difficult. You can call them on 0300 200 3500 or visit their website at hmrc.gov.uk/. They will be able to help you figure out what to do next and how to get back on track with filing your taxes.

Keep a Record of What Your UTR Number Is

Another important thing to do if you lose your UTR number is to keep a record of what it is. This can include writing it down or keeping it in a safe place.

If something happens and you lose your UTR number, having a record of where it is will make it easier for you to get it back. There are a few things you can do in order to keep track of your tax affairs:

- Keep a copy of your P60 and any other returns that include your UTR number

- Add [taxpayer reference number] to the contact information for all of the account numbers, bank addresses, and other personal information associated with your financial life.

- Create an online profile using services like LinkedIn or Facebook

- Keep a copy of all the documentation proving you are who you are.

As long as you have this documentation handy, you’ll be able to submit tax returns, make payments, and access your account information.

File Your Taxes Using an Alternative Method If You Cannot Get Access To Your Previous Tax Returns

If you cannot get access to your previous tax returns, File Using an Alternative Method advises that you file using Form 8606-A – Application for an IRS E-file Participation Credit. This form can be downloaded from irs.gov and will allow you to file your taxes using the e-file system. You will need to provide your UTR number, your taxpayer identification number (TIN), and the dates of your tax returns.

Consider Hiring a Tax Professional If You Cannot File Your Taxes Yourself

If you cannot file your taxes yourself, consider hiring a tax professional. They will be able to help you figure out which forms to file, where to file them, and how to get the most benefit from filing through the e-file system.

Consult a Lawyer If You Have More Questions About Your Tax Status

If you have more questions about your tax status or if you think you may be liable for any taxes, consult a lawyer. They can help you figure out what to do next and whether or not you may be able to get your money back.

Stay Up to Date on Tax Changes

Finally, it is important to stay up to date on tax changes. This includes knowing which forms to file and when and any changes to the tax laws that may affect you. If you have any questions about these things or if you need help filing your taxes, don’t hesitate to contact a tax professional.

How to Find a Lost UTR Number in UK?

UTR stands for Unique Taxpayer Reference Number and is a unique nine-digit identification number assigned by HMRC to every individual taxpayer in the UK. It’s important because it allows HMRC to track your tax affairs and, should you have any queries or problems with your tax returns, to find the relevant records quickly and easily. If you’ve lost your UTR or if you need to update your details, here’s how you can do it,

If you have lost your Unique Taxpayer Reference Number (UTR), you can find it using the following steps.

First, you will need to check if your UTR has been cancelled or is not currently in use. If your UTR is cancelled, you will need to contact HMRC to receive a new number. If your UTR is not currently in use, you can find out how to request a new number here.

How to Find a Lost UTR Number in UK for an Individual?

Once you have confirmed that your UTR is lost or not currently in use, you can start the search process by checking the following sources:

1. The HMRC website – As mentioned earlier, the HMRC website has information on how to request a new UTR and also lists any cancelled numbers.

2. Your bank account statements – If your bank issued your UTR, they might have sent out a statement outlining which numbers are associated with which accounts. You can search for this information using the ‘find my account’ feature on most banks’ websites.

3. Local newspapers – Local newspapers may carry reports of people who have lost their UTRs and may be able to help you locate them. You should also check with local government offices as they may hold records of people who have had their citizenship revoked or who have moved house recently and forgotten to update their address with the relevant authorities.

4. Social media platforms – If you cannot locate your UTR through any of the other methods listed, social media platforms may be a good place to start. You can post a message on a relevant Facebook group or Google+ page or contact other members of your family who may have known your UTR.

If you have lost your UTR and are unable to locate it, you will need to request a new number from HMRC. You can find out how to do this here.

How to Find a Lost UTR Number in UK for Sole Trader?

1. Begin by using the UTR number lookup tool on the HMRC website.

2. Enter the full UTR number into the search bar, and click on ‘search’.

3. If the number is found in the results, it will be displayed below with a link to an HMRC page explaining what it is and where to find more information if required. If the number is not found, please continue to step 4.

4. If you are a sole trader, you will need to complete a Self Assessment Tax Return (SATR) form and provide your UTR number as part of your business details. The HMRC website has detailed instructions on how to do this.

If you need to update your UTR number, please get in touch with the HMRC helpline.

How to Find a Lost UTR Number in UK for Self Employed?

If you are self-employed and have lost your Unique Taxpayer Reference Number (UTR), there are a few things you can do to find it.

- First, ensure you have kept your invoices, receipts, contracts, and other documentation related to your small business. If you can’t find these items, ask your accountant or lawyer for help.

- Next, contact the HM Revenue and Customs (HMRC) if you think you may have lost your self-employed UTR number. They will be able to check your records and advise whether or not you need to take any action.

- Finally, if all else fails and you still cannot locate your UTR, consider registering for a new one through HMRC’s online service.

This process is quick and easy and will ensure that HMRC has a complete record of all of your business activities.

How to Find a Lost UTR Number in UK for a Limited Company?

If you are a limited company in the United Kingdom and have lost your UTR number, you need to take action to find it. The UTR number is a unique tax identifier for limited companies in the UK. Without it, you may experience some difficulty filing your tax returns, managing your company’s finances, or doing business with government recruitment agencies.

To find your UTR number, start by consulting the Companies House website. This website provides detailed information on company registration, including your UTR number and contact details. Once you have located your UTR number, you can use the contact information to get help from companies such as HMRC (Her Majesty’s Revenue and Customs) or the Bank of England.

How to Find a Lost UTR Number in UK for Construction Project?

In order to find a lost UTR number in the United Kingdom for a construction project, follow these steps,

1. Research your company’s UTR history online. The UK government maintains a public database of UTRs, so you can easily check if your company has ever had one assigned to it.

2. Check with the Department for Work and Pensions (DWP) if you cannot find your company’s UTR history online. They may have records older than the government’s database, or they may be able to help you contact your former clients or subcontractors to ask if they know of your UTR number.

3. Contact your customers and subcontractors directly if you still cannot find your company’s UTR history or if you are unable to reach the DWP. Ask them if they know of your UTR number and whether they can provide you with a copy of it. If not, offer them a discount on future projects in exchange for the number.

4. Finally, contact the HMRC Taxpayer Services team to ask for help locating any lost or forgotten UTR numbers from recent tax years. They will be able to search through their records and identify any that may belong to your company.

Conclusion

If you have lost your UTR number UK, don’t worry – we’ve got you covered. In this article, we will walk you through the process of finding your UTR number and give some tips on how to keep it safe. Whether you are starting a business or an individual who relies on phone and internet services, keeping track of your UTR is essential for preventing any unwanted legal issues.

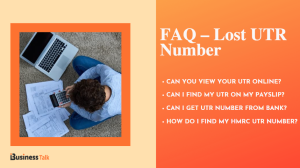

FAQ – Lost UTR Number

Can you view your UTR online?

Unfortunately, the UTR number is not currently available online. You can obtain a unique taxpayer reference number by visiting your local tax office or by registering for the My Gov website.

Can I find my UTR on My Payslip?

You can’t find your UTR on your payslip, but you can find it on your tax form. It is a unique taxpayer reference number that the UK Tax Office needs to ensure that taxes are paid correctly.

Can I Get UTR Number From Bank?

You can definitely get your lost UTR number from the bank. Simply call them and provide the following information: your full name, date of birth, street address and postcode. Once they have this information, they will be able to issue you with a new UTR number.

How do I find my HMRC UTR number?

You can find your HMRC UTR number by visiting https://www.gov.uk/hmrc-utr. If you have a PAYE or Self- Employed pension scheme, then it is likely that your UTR number is already included in your due date account statement.