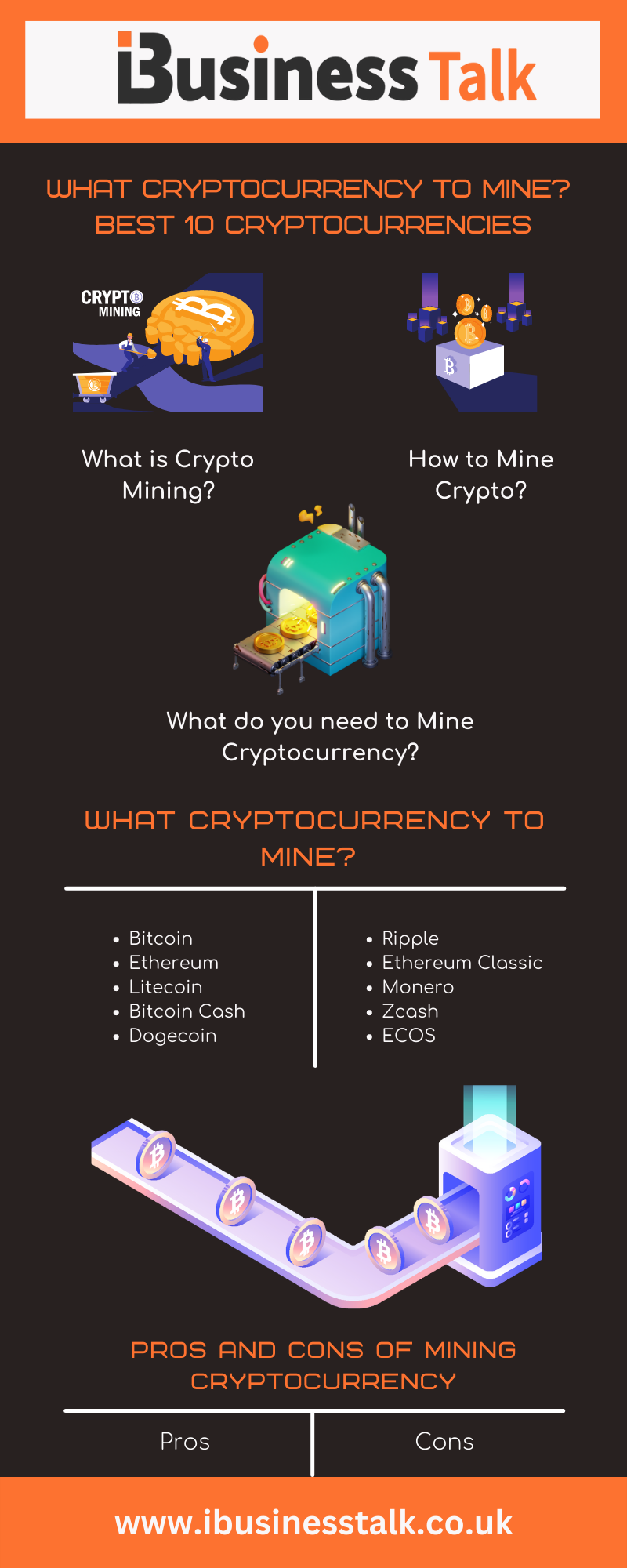

What Cryptocurrency to Mine? – Best 10 Cryptocurrencies

Introduction

Cryptocurrency mining is the process of creating new currency miners verify and add transactions to the blockchain ledger. In return, they are rewarded with a small number of new coins. Mining is an important and integral part of Bitcoin and other cryptocurrencies.

It ensures the security of the network and confirmations of transactions. However, as mining difficulty increases, it becomes more and more resource-intensive and expensive.

Which begs the question: what cryptocurrency should you mine? This blog post will explore the top 10 cryptocurrencies to mine in 2020. We’ll also provide a brief overview of each currency so that you can decide which one is right for you.

What is Crypto Mining?

Cryptocurrency mining is the process of verifying cryptocurrency transactions in the blockchain ledger. Miners are awarded cryptocurrency for this service.

Cryptocurrency mining requires special hardware and software setups. Mining rigs often consist of multiple high-end graphics cards, costing thousands of dollars. ASIC miners are purpose-built machines that offer significantly higher performance than GPUs.

Profitable cryptocurrency mining depends on several factors, including the cryptocurrency’s price, the mining algorithm’s difficulty, and the electricity costs of running the miner.

When a cryptocurrency is profitable to mine, it means it’s profitable to go through the mining process. For example, Ethereum is more profitable to mine than Bitcoin at the time of this writing.

If you’re interested in mining cryptocurrency, you’ll need to research to find out if it’s a viable option. In addition to understanding the basics of cryptocurrency mining, you’ll need to factor in the costs of equipment, electricity, and cooling when deciding whether or not to mine.

How to Mine Crypto?

Cryptocurrency mining is the process of authenticating and recording transactions using digital ledgers known as blocks. Miners are rewarded with cryptocurrency for their efforts – typically in the form of newly-issued coins or transaction fees.

There are two main ways to mine cryptocurrency: solo and pool mining. Solo mining means you verify and add blocks to the blockchain yourself and are therefore eligible to receive the entire block reward (typically 25 BTC/ETH + transaction fees).

Pool mining means you join forces with other miners to work on the same block, and the rewards are shared proportionally among all members of the pool.

In order to start mining, you’ll need to acquire some basic equipment. This includes a computer with decent processing power (GPUs are best), a cryptocurrency wallet to store your earnings, and specialized mining software.

Once you have everything set up, you’ll need to join a mining pool (optional) and start pointing your rigs at one or more cryptocurrency algorithms.

The most important thing to remember is that cryptocurrency mining is a very competitive business. To succeed, you’ll need to invest time and money in cryptocurrency in your operation.

When it comes to mining cryptocurrency, there are a few things you need to take into account. The first is what kind of cryptocurrency you want to mine. There are many different types of cryptocurrencies, each with its own benefits and drawbacks. You’ll need to research to determine which one is right for you.

Once you’ve decided which currency you want to mine, you’ll need to set up a mining rig. This can be a complex process, but plenty of resources online can help you out. Once your rig is up and running, you’ll start mining blocks of the currency and earning rewards for your efforts.

Mining cryptocurrency can be a great way to earn some extra income, but it’s important to do your research and understand the risks involved before getting started.

What do you need to Mine Cryptocurrency?

To mine cryptocurrency, you need a few things. First, you need a computer with a decent amount of processing power. You can get by with a slower computer for some currencies, but for most mining, you will want something that can handle a lot of number crunching.

You’ll also need a mining program. This will be used to connect to the network of miners and help solve the complex mathematical problems that are necessary to earn rewards in the form of cryptocurrency. There are many different programs out there, so make sure to do your research before settling on one.

Finally, you’ll need somewhere to store your newly mined currency. This is typically done in what’s called a “wallet.” Again, many different options are available, so choose the one that best suits your needs. With these three things in hand, you’re ready to start mining cryptocurrency!

What Cryptocurrency to Mine?

Mining cryptocurrency can be a great way to earn a passive income, especially if you have the right hardware. In this section, we’ll go over some of the basics of how to mine crypto.

The first thing you’ll need to do is choose a cryptocurrency to mine. There are many different cryptocurrencies out there, so it’s important to pick one that is profitable and has low fees. Once you’ve chosen a currency, you’ll need to download mining software and join a mining pool.

Mining pools are miners working together to mine a block of transactions. The good news is that joining a pool can increase your chances of earning rewards. After you’ve set up your mining software and joined a pool, you’ll be able to start mining!

Bitcoin

Bitcoin is the original and most well-known cryptocurrency. Bitcoin was created by Satoshi Nakamoto nine years ago. It is based on a decentralized, peer-to-peer network. Bitcoin is often seen as the digital gold standard and has inspired many other cryptocurrencies.

Bitcoin is mined by solving complex mathematical problems. The miners are rewarded with bitcoins for their efforts. A finite number of bitcoins can be mined, and the supply is slowly decreasing over time. This makes Bitcoin a deflationary currency, potentially increasing in value over time.

Bitcoin is widely accepted as a payment method, and it has been growing in popularity in recent years. However, it is still not as widely accepted as traditional fiat currencies.

Ethereum

Ethereum is a decentralized open-source blockchain that enables smart contract functionality. It is the second most popular cryptocurrency after Bitcoin and has gained popularity recently. Ethereum is a good choice for mining as it is still profitable and has a large community of users.

Litecoin

Litecoin is best known as being the younger brother of Bitcoin and was created in 2011 by Charlie Lee. It is similar to Bitcoin but with a few key differences. One of those differences is that Litecoin has a faster block time, meaning transactions are confirmed faster.

Another difference between Litecoin and Bitcoin is that the former uses a hashing algorithm called Scrypt. This allows miners to use less powerful hardware, making it more accessible for people to mine.

If you’re looking to get into cryptocurrency mining, Litecoin might be a good option for you.

Bitcoin Cash

Bitcoin Cash is a cryptocurrency coin that was forked from Bitcoin in the year 2017. It is similar to Bitcoin in many ways but has a few key differences. One of the biggest differences is that Bitcoin Cash has a larger block size, which allows for more transactions to be processed.

This makes Bitcoin Cash a better choice for those looking to use cryptocurrency for day-to-day transactions. Another difference is that Bitcoin Cash uses a different mining algorithm than Bitcoin, which means that it can be mined with less expensive hardware.

Dogecoin

Dogecoin is a cryptocurrency that started as a joke but has since grown to become a popular choice for miners. Dogecoin is based on the Litecoin protocol and has many of the same features as other cryptocurrencies.

However, Dogecoin’s block time is only 1 minute, which makes it much easier to mine than other cryptocurrencies. Dogecoin also has a large and active community, which makes it a good choice for miners who want to be involved in the cryptocurrency community.

Ripple

Ripple is a cryptocurrency that was created in 2012; unlike other digital currencies, Ripple isn’t mined; instead, it’s created by the Ripple company when they purchase their own units from the system. Ripple can be used to make international payments; some businesses also accept it as a form of payment.

Ethereum Classic

Ethereum Classic is a decentralized platform that allows you to create and execute smart contracts. Smart contracts run as planned, free from third-party interference. Ethereum Classic also features a blockchain. A blockchain is like an openly distributed database with no central ownership or authority, where millions of nodes hold all the data on it.

Monero

Monero is a cryptocurrency that guarantees privacy and security at all times. And it was created with the goal of being untraceable, unlikable, and fungible. It is one of the most popular cryptocurrencies, and it is often considered to be a good option for mining. Monero uses a Proof of Work algorithm, and it can be mined with CPUs and GPUs.

Zcash

If you’re looking for a cryptocurrency with privacy features, Zcash may be your best option. Zcash is a blockchain-based, decentralized cryptocurrency that offers anonymity and comes with the features of transparency.

Zcash is built on the Zerocoin protocol, which makes it more anonymous than other cryptocurrencies like Bitcoin. When a user sends a Zcash transaction, their IP address, transactional data, and wallet balances are all hidden.

However, users have the option to “shield” their transactions so that they are visible on the blockchain. This feature allows for greater transparency when needed or required by law.

ECOS

The most important factor to consider when deciding which cryptocurrency to mine is the level of difficulty. The mining process requires a lot of computing power and can be quite expensive. As the difficulty level increases, so does the cost of mining.

There are two main types of cryptocurrencies, Bitcoin and Ethereum. Bitcoin is the more established cryptocurrency with a larger market cap. Ethereum is newer but has attracted a lot of attention from investors.

When considering which cryptocurrency to mine, it’s important to look at the long-term prospects for each coin. What is the team behind the project working on? What is the roadmap for development? What partnerships have been announced? All of these factors can give you an idea of which coins are worth investing in for the long term.

Pros and Cons of Mining Cryptocurrency

There are many different factors to consider when trying to decide which cryptocurrency to mine. Some of the most important things to keep in mind:

1. The current market value of the coin

2. The difficulty of mining the coin

3. How much energy it takes to mine the coin

4. What equipment is needed to mine the coin

Coin values can fluctuate greatly, so it is important to research before investing in any coin. Mining difficulty can also change over time, making some coins easier or harder to mine.

If a coin is particularly difficult to mine, it might not be worth your investment. Energy consumption is another big factor, as mining can require a lot of electricity. Ensure you consider all of these things before deciding which cryptocurrency to mine!

Some people believe that mining cryptocurrency is a great way to earn extra money. Some people think that it’s time and resource-consuming, while others see it as a necessary evil. There are pros and cons to both side’s arguments,

Pros

1. You can earn extra money by mining cryptocurrency.

2. Do you enjoy a good challenge? If so, you might try gold mining as a fun hobby.

3. You can learn much about blockchain technology and how it works by mining cryptocurrency.

4. Some believe mining helps secure the network and prevents 51% of attacks.

Cons:

1. Mining is resource-intensive and can result in high electric bills.

2. Mining equipment can be expensive.

3. The value of creating cryptocurrency can be volatile, so you might not always make a 4. profit from mining.

Conclusion

There are many different factors to consider when trying to decide which cryptocurrency to mine. However, by considering the current market conditions and your business proposal and personal goals, you should be able to find the right currency. We hope that our list of the best 10 cryptocurrencies to mine in 2019 has given you a good starting point in your research.